iShares MSCI South Africa UCITS ETF USD (Acc) | IRSASign In to View Ratings |

| Performance History | 31/05/2025 |

| Growth of 1,000 (GBP) | Advanced Graph |

| Fund | 4.9 | 8.0 | -4.1 | 8.3 | 14.9 | |

| +/-Cat | -12.8 | -1.7 | 1.3 | -4.3 | 8.2 | |

| +/-B’mrk | -15.1 | -1.4 | 0.0 | -3.6 | 4.2 | |

| Category: South Africa & Namibia Equity | ||||||

| Category Benchmark: FTSE/JSE All Share TR ZAR | ||||||

| Key Stats | ||

| Closing Price 11/06/2025 | USD 44.17 | |

| Day Change | 0.65% | |

| Morningstar Category™ | South Africa & Namibia Equity | |

| Volume | 1240 | |

| Exchange | LONDON STOCK EXCHANGE, THE | |

| ISIN | IE00B52XQP83 | |

| Fund Size (Mil) 10/06/2025 | USD 119.44 | |

| Share Class Size (Mil) 10/06/2025 | USD 119.44 | |

| Ongoing Charge 27/01/2025 | 0.65% | |

| Investment Objective: iShares MSCI South Africa UCITS ETF USD (Acc) | IRSA |

| The investment objective of this Fund is to provide investors with a total return, taking into account both capital and income returns, which reflects the return of the MSCI South Africa 20/35 Index. In order to achieve this investment objective, the investment policy of this Fund is to invest in a portfolio of equity securities that as far as possible and practicable consists of the component securities of the MSCI South Africa 20/35 Index, this Fund’s Benchmark Index. |

| Returns | |||||||||||||

|

| Management | ||

Manager Name Start Date | ||

Not Disclosed 22/01/2010 | ||

Inception Date 22/01/2010 | ||

| Advertisement |

| Category Benchmark | |

| Fund Benchmark | Morningstar Benchmark |

| MSCI South Africa 20/35 USD | FTSE/JSE All Share TR ZAR |

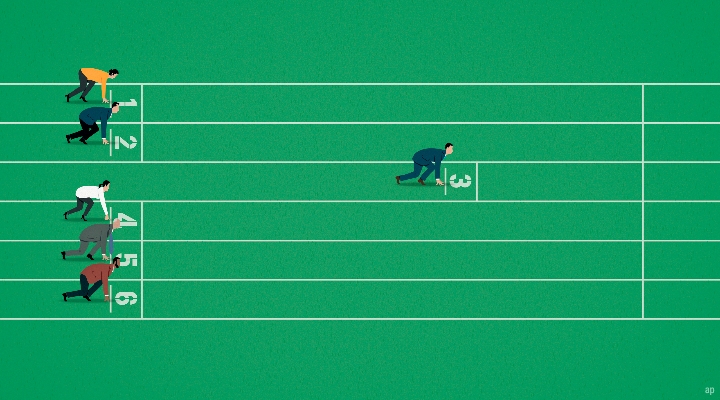

| Target Market | ||||||||||||||||||||

| ||||||||||||||||||||

| Portfolio Profile for iShares MSCI South Africa UCITS ETF USD (Acc) | IRSA | 09/06/2025 |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||

| Top 5 Holdings | Sector | % |

Naspers Ltd Class N Naspers Ltd Class N |  Consumer Cyclical Consumer Cyclical | 17.70 |

Anglogold Ashanti PLC Anglogold Ashanti PLC |  Basic Materials Basic Materials | 8.17 |

Gold Fields Ltd Gold Fields Ltd |  Basic Materials Basic Materials | 7.76 |

Firstrand Ltd Firstrand Ltd |  Financial Services Financial Services | 7.55 |

Standard Bank Group Ltd Standard Bank Group Ltd |  Financial Services Financial Services | 6.13 |

Increase Increase  Decrease Decrease  New since last portfolio New since last portfolio | ||

| iShares MSCI South Africa UCITS ETF USD (Acc) | IRSA | ||